Posted on September, 19, 2024 at 09:33 am

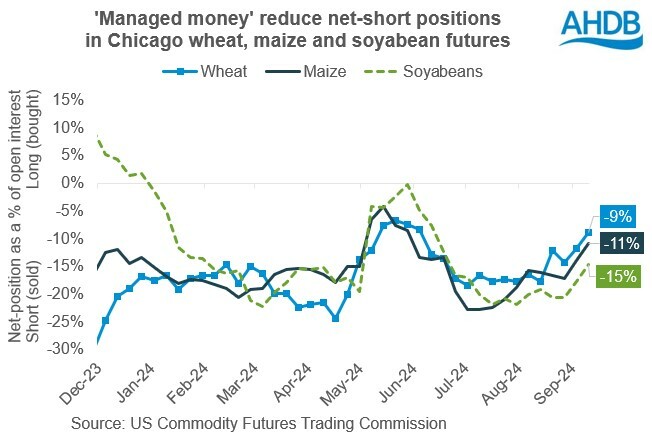

Speculative traders, including investment funds, reduced their net-short positions in key grain and oilseed futures markets recently. The latest data (released Friday) shows that as of 10 September ‘managed money’ held the smallest net-short positions in Chicago wheat and soyabeans since 4 and 18 June respectively. This category of trader also held the smallest net short in Chicago maize since 28 May.

The recent reduction to the net-short positions held by all ‘managed money’ in the Chicago markets comes amid increased uncertainty in markets and building in more ‘risk premium’. Recent drier weather in the US (meaning some uncertainty over maize and soyabean yields), and the drought in Brazil are the key factors for maize and soyabeans. Recent cuts to EU crop estimates along with concerns about access to and the size of Black Sea grain crops, also bring uncertainty, particularly for wheat.

Holding short positions can provide profits to these types of traders when prices decline. However, price rises can mean losses and a need to ‘cover shorts’ to minimize losses. Conversely, a long position can be used to profit from a rising market.

Anecdotal information from Refinitiv suggests that since 10 September the funds may have reduced their short positions further in all three markets. But speculative traders remain short overall, likely in part reflecting projections for global markets to be well supplied with maize and soyabeans in 2024/25.

Meanwhile, for the Paris wheat and rapeseed futures markets the latest data is for 6 September (released 11 September). It also shows a similar shift, with investment funds holding reduced net-shorts in Paris wheat futures and the largest net-long in Paris rapeseed since late-July.

Short covering often follows and can also offer support to prices. For example, from 27 August to 10 September, Chicago wheat futures (Dec-24) gained 7%, with Chicago maize (Dec-24) up 3% and Chicago soyabeans (Nov-24) up 1%.

Looking ahead, if crop estimates decline or there’s further threats to the access to Black Sea grain, there’s a risk of more short covering. This could in turn accelerate any price gains. However, if some of the risk proves unfounded, such as from good US yields, market sentiment could turn more negative again. This in turn could cause speculative traders to re-build their net-short positions, which could weigh on prices.

Source; AHDB