Posted on November, 28, 2024 at 08:05 pm

A smaller UK wheat crop in 2024, along with some quality issues has stimulated additional imports of milling wheat this season. With UK wheat imports increasing on the year, the influence of global grain price movements on domestic prices is strengthening. The global wheat market is focused on Chicago wheat and Paris wheat futures.

The CME Group launched Chicago Wheat to European Milling Wheat Spread futures in October, which could help to better manage price risks between different continents. Traders could fix the spread in the right moment and hedge against unfavourable price movements (arbitrage).

For the UK domestic market, of course, the best price risk management tool is UK Feed Wheat Futures (ICE). A forward contract with fixed basis could help farmers mitigate price and logistical risks. Comparing nearby futures for the last year, we can draw conclusions about the general price trends for UK feed wheat futures, Paris milling wheat and maize futures, Chicago wheat and maize futures. The main trend in price movements is repeated, as can be seen in Figure 1.

However, for the hedging strategy we need to do a deep analysis of the interdependencies between the prices. If markets are not highly correlated, it is not possible to hedge price risk movements effectively.

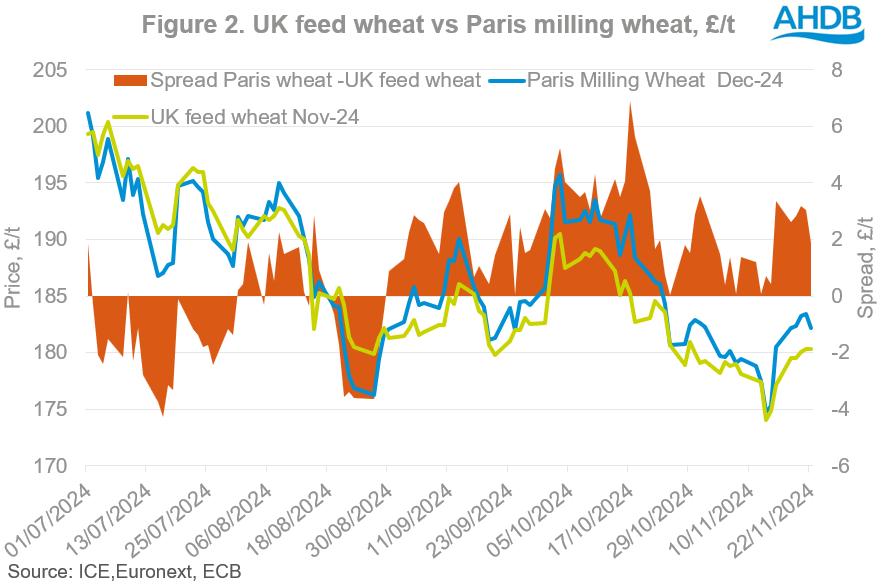

Since the beginning of the current marketing year (July 2024), Paris milling wheat futures (Dec-24) and UK feed wheat futures (Nov-24) had a very good correlation. More interestingly, the price difference between these futures from 1 July to 22 November (last trading day for UK feed wheat Nov-24) is only £1.00/t on average. The highest level of difference was £6.90/t and the lowest was -£4.30/t. From this analysis we can conclude that UK farmers can use Paris milling wheat futures as an additional option to manage wheat price risk.

In theory, farmers have so many tools at their disposal to manage price risk, especially for wheat. But before any action is taken all the historical data on futures price movements needs to be analysed. UK feed wheat futures are the best tool for the price risk management, because the basis risks are generally lower than the price risk volatility. For example, in one marketing year the difference between minimum and maximum wheat prices is £20/t, but at the same time the difference between minimum and maximum basis is £5/t.

As an additional option for price risk management option, UK farmers could use Paris milling wheat futures, particularly for milling wheat, which is mainly imported from the EU.

Source: AHDB