Posted on February, 26, 2025 at 09:26 am

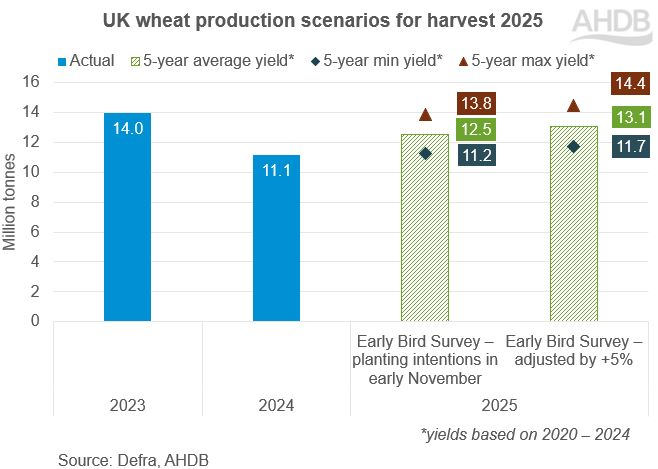

AHDB’s Agri-market outlooks for cereals, released yesterday, shows UK wheat production in 2025 is set to rise from 2024 levels. This is based on production scenarios calculated using AHDB’s Early Bird Survey (EBS) and the lowest, average and highest yields from the past five years (2020-2024, Defra).

Production would rise from 2024’s 11.1 Mt, even under a low yield scenario (2020’s 7.0 t/ha), due to the 5% rebound in the crop area. Using the EBS area and the average yield from 2020-2024 (7.8 t/ha), production could be around 12.5 Mt.

However, anecdotal reports suggest that a slightly higher area of wheat has been planted than reported in the EBS, which is a survey of planting intentions. This is likely due to concerns over the wet start to the autumn and doubts over whether winter plantings would be completed (after the survey had taken place).

Because of this, we have looked at an alternative scenario too, adding an additional 5% onto the EBS area estimate. Yet even under this alternative scenario, unless yields are above average, production would still not return to the 2019-2023 average production level of 13.9 Mt.

The next few months, as spring drilling progresses and the winter crops develop, will be key for indicating what we can expect yield-wise. Given a challenging start, achieving the average to five-year maximum yield across the UK would require particularly favourable conditions for the rest of the season. Look out for AHDB’s first crop condition report of 2025 on 28 March.

Also, with your help, AHDB’s 2025 Planting and Variety Survey will give further insight into the area for harvest 2025. The survey opens on 7 April 2025.

What does this mean?

New crop domestic feed wheat futures (Nov-25) have been trading at a premium to old crop prices since the end of November 2024. This is due to uncertainty over both UK and global production prospects in 2025, plus potential for above-average UK stocks at the end of 2024/25.

Meanwhile, there's a risk of upward pressure on nitrogen fertiliser prices given rises in natural gas prices over the winter. Look out for a fertiliser outlook for 2025 later today; the final part of our annual Agri-market outlook.

So, while drilling is understandably the focus, try to squeeze in a moment to reflect on how your marketing plans for harvest 2025 crops compare to the crop’s potential and budgeted costs.

Source: AHDB